Directional trading aims to capitalize on the shareholder's anticipation of future market movement. You'll be placing a prediction based on whether the business will go up or down with this method, which is dependent simply on the market's direction. When engaging in directional trades, one must take a net asset or net stock portfolio inside a given market. A net extended asset allocation will yield positive results in an upward market movement. In contrast, a net negative directional trade will deliver positive results in the event of a market movement to the downside.

Directional Trading:

Simply, directional trading is placing a bet on whether the market or specific securities will move higher or down. It is commonly connected with options trading because several tactics may benefit from an uptrend or decrease in the overall market or a specific stock. Investors may use a fundamental directional trading strategy by holding a stagnant place in the underlying market or security when the price increases and a short-term position in the underlying market or security when the price drops.

To generate a profit through directional stock trading, the trader usually requires the stock price to shift by a substantial number. However, because of the leverage offered by possibilities, directional trading could be done even if a significant change in the company's securities is not predicted. As a whole, options provide a lot more leeway for structuring directional bets than simple long/short stock or index trading.

A broker or shareholder engaging in directional trading must have high confidence in the short-term trajectory of the market or asset in question. They must also have a plan to limit losses should prices go in the opposite direction.

Types of Directional Trading

Calls and puts are the two primary tools used in trading techniques. Initially, investors attempt to forecast the direction the market will go. After that, investors have the opportunity to generate spreads by trading and buying possibilities at a variety of strike prices. There will be less of a financial and security impact if you opt for this option.

Bull Call

Bull calls are sent out by investors who anticipate a rise in market prices. This is made possible by purchasing a lesser strike price capital gain and selling a more significant strike price call alternative. Shareholders will be obligated to pay a surcharge to buy the call option. A more considerable premium is paid for possibilities with a lower strike price due to the increased value of these contracts. Investors can earn compensation by selling a call option instead of buying one, which might be more costly.

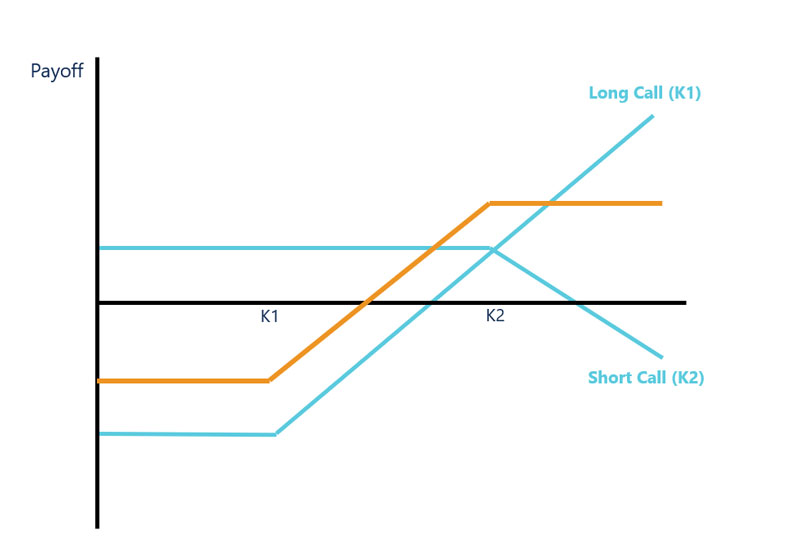

A bull cry is depicted in the following diagram. You may think of the vertical axis as the payback and the reference point as the cost. Bothbot long and short positions on a call option are depicted by the blue lines, while the orange line represents the payment of a bull call option at possible underlying equity prices. A bull call's amount increases as the price rises, as the bet is that the price will rise. The graphic also demonstrates that the long call's reward is smaller than that of the bull call whenever the value is low. Long calls have the potential for bigger payouts than bull calls because the author's payout is capped once the price equals the K2 market price.

Bull Put

A bet known as a bull put is placed with the expectation that market conditions will improve and price levels will rise. It is comparable to bull calls, except that put options are used. When an investor purchases a put option with a significantly lower price and then sells a put option with a higher cost, the investor has created a bull put. If prices go lower, a bull put is likely to result in fewer losses compared to a long put. However, this limits the amount of money that may be made through the option. As a result, there is less variation in the working capital.

Bear Call

A bear call is a prediction that market rates will decrease. This is manufactured by dealers or brokers who trade a call with a reduced strike price and purchase a contract at a high strike value. Like most other-directed strategies, the option has fixed maximums on its losses and gains. There will be less upheaval overall, which is a benefit of the approach. A bear call investor will incur fewer liabilities than a call option trader if prices rise.

Bear Put

Bear puts, identical to bear calls, provide a profit whenever the exchange price drops. Bear puts, like bear calls, provide income when market values decline. Bear puts are made when shareholders trade at a low-strike put and simultaneously purchase a high-strike.

A bear put reduces volatility for less money than just purchasing a put option. An investor can recoup some of the expense of buying a high-strike-price futures contract by trading a put option in exchange for the premium. A greater market rate on a put option means more money in the purchaser's pocket since they'll be capable of selling the asset class for a more excellent price.

The payment will be at its most significant point before the underlying security hits the contract price. This confirms the investor's estimate and results in substantial returns despite relatively low prices. Whenever the payout of the bear pitfall is in a linear fashion, the cost of the underlying asset increases. Nevertheless, it is not as small as it would be if the selloff on another put option did not yield a positive return. Having simply a long-put option would result in a lower payment.