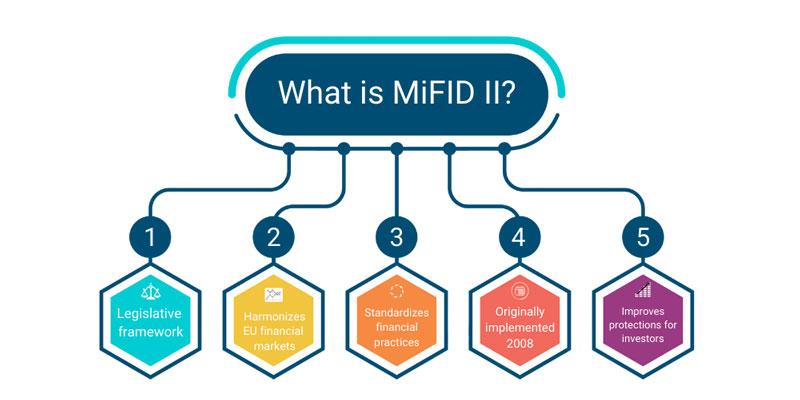

The MiFID II stands for Markets in Financial Instruments Directive, Version 2. A European financial market law applies to documentation service suppliers, financial institutions, and trading platforms. The Markets in Financial Instruments Directive II (MiFID II) establishes guidelines for the operation and regulation of investing businesses within the European Union.

In addition to establishing a new kind of trading arena, MiFID II also details a legislative framework for the financial markets. This article will investigate MiFID II and its potential effects on your company and the commercial transactions reporting processes.

Beginnings of the MiFID

In 2004, the first version of MiFID was put into place. 2007 was the year when it went into force throughout the EU. Since the law's conception, it has been put to work as a mechanism to assist in the creation of a consolidated and transparent financial system across the EU. The MiFID comprises several critical directives, including the following:

- Specifies what must be done to control the global trading system

- Establishes standards of behavior and procedures for financial institutions involved in investments.

- Demands openness in all commercial dealings

- Details the steps that must be taken in the case of market or organizational misuse involving money or money transfers

MiFID II is the outcome of 2+ years of negotiations, counterarguments, and talks after a recommendation for improvements to MiFID that was drafted at the end of 2011 by the European Commission, which developed and administered the existing MiFID. After the EU Senate and Parliament approved the last set of changes, MiFID II was officially accepted in the middle of 2014.

What Does the MiFID II Regulation Entail?

MiFID II is a European policy that seeks to control the financial markets and give shareholders more security. By bringing more businesses under the jurisdiction of an EU banking regulation, the purpose of MiFID II is to create uniformity across the EU.

MiFID II: Who and What It Regulates

If you are wondering what is included in the scope of MiFID II? The immediate solution is that everything is associated with the finance sector.

In further detail, the MiFID regulates:

- Banking on Funds and Managers

- Markets worldwide

- Moneylenders and their bosses

- In any market places where

- Investments for Retirement

- Traders

- Brokers

- Investors

The marketplaces that MiFID II is meant to regulate are also a significant cause for worry.

- Capital gains

- Commodities that will be traded on an exchange in the future that is based on the price of

- In-store Derivatives Across the Board

When Did the MiFID II Regulations Go Effective?

Since January 3, 2018, some of MiFID II's rules have applied to companies in the United Kingdom. The date for the MiFID II law to become effective was previously intended for January 2017. However, it was prolonged due to fears that companies and public governments would not be capable of adhering to the standards of MiFID II.

Who Is Affected by MiFID II?

The EU enacted the Markets in Financial Instruments Directive II to strengthen investor safeguards and oversee the capital sector inside the EU. In addition to including practically all investment advisers in the EU, it also encompasses nearly every facet of financial investing and trade.

Institutional and ordinary investors and those who work in banking, trading, managing funds, or working for exchanges must all adhere to its requirements. More specifically, it decreases the prevalence of shadow pools and OTC transactions.

Why is MiFID II Necessary?

Third-party incentive schemes made to investment companies or finance professionals in exchange for customer services are limited under MiFID II. As a result, shareholders will have a deeper understanding of the costs associated with research and operations, and financial institutions and broker-dealers could be more motivated to improve their research quality.

Brokers will be required to submit more knowledge, especially quantity and price data, on their transactions. They must keep records of all phone calls; automated trading is preferred since monitoring, and archiving transactions are simpler.

What Is a "Dark Pool"?

Dark pools are non-public asset marketplaces that facilitate the private exchange of big blocks of commodities. They say that the individual investors who put money into buy-side entities like mutual funds and retirement funds profit in the long run from the lower costs and better prices they receive. Yet, their lack of openness makes dark pools ripe for unscrupulous trading by HFT businesses and ownership interest conflicts.

Importance of MiFID II

- MiFID II regulates practically all financial instruments and activities within the European Union. More trading occurs on regulated markets due to the tightening of OTC and exchange markets.

- Financial institutions are obligated under MiFID II to determine whether or not a client is a good fit for a particular financial instrument. Considerations like a customer's risk tolerance and capacity to withstand financial setbacks are crucial.

- Each product must be evaluated separately and from the user's overall investment portfolio perspective to determine its eligibility. When deciding whether or not to sell a subscriber an additional investment opportunity, companies must now consider the consumer's existing portfolio.

- Businesses must also classify their customers as either "commercial," "highly qualified," or "qualified stakeholders" based on how well they comprehend financial goods. The items that can be made available to customers depend on their categorization.

- As part of MiFID II, businesses must keep detailed records of their telephonic and electronic exchanges with clients. Corporations are obligated to record and monitor these kinds of interactions. If a supervisor like the FCA requests this information, businesses must provide it as soon as possible.

- Call logs, email chains, text messages, and social media posts are business documented per MiFID. The need to record conversations also applies to those happening within an organization rather than just outside.

- It doesn't matter where an organization's operations are based in the world. If it meets the criteria for an equity firm, it must follow the rules laid forth in MiFID II.

Conclusion

The revised MiFID II aimed to simplify and strengthen the EU's framework for regulating the capital sector. Most significantly, MiFID II was developed because of the alterations required to accommodate the development and evolution of fintech.