Are you in the market for a home but need help figuring out where to start? A 2-1 buydown mortgage may be just what you need! This unique financing strategy allows borrowers to temporarily reduce their interest rate using cash payments or home equity.

In this blog post, we'll explain a 2-1 buydown and how it works so that you can decide whether this type of mortgage is right for your situation. Read on to learn more!

What Is a 2/1 Buydown

A 2/1 Buydown is a type of mortgage financing where the borrower pays cash or makes home equity payments to temporarily reduce their interest rate for two or three years. This mortgage can help borrowers save money on their monthly mortgage payments, but there are some important considerations to remember.

How Does a 2/1 Buydown Work

A 2-1 buydown mortgage is a unique way to finance a home. In this type of mortgage, the lender agrees to lower the borrower's interest rate for two initial years and then increase it for the remaining term of the loan.

This buydown can be achieved in one of two ways: by making cash payments at closing or by taking out an additional loan (typically a home equity loan) to cover the money needed for the buydown.

Cash payments or additional loans are used to "buy down" the interest rate, meaning you purchase a discounted rate in exchange for making upfront payments. During the two-year period where your interest rate is lowered, you will pay less overall than if you had taken out a loan with the standard market interest rate.

After the two-year period has ended, your payments will go back up to the original market rate for the duration of the loan.

Example of a 2/1 Buydown

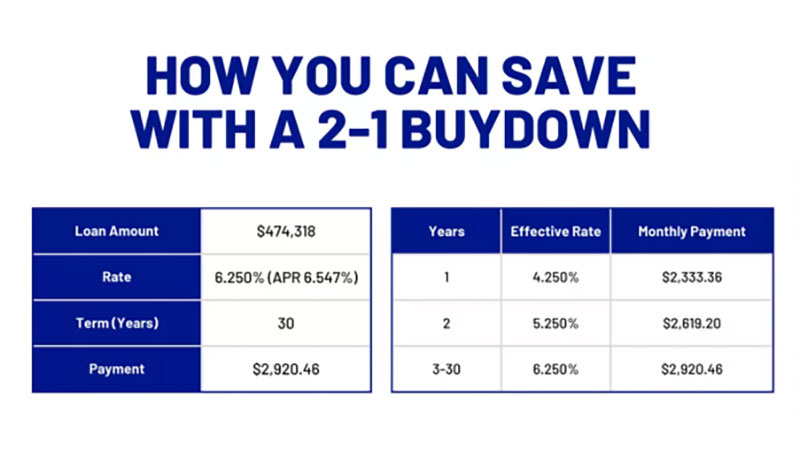

For example, let's say that a borrower takes out a 30-year loan for $200,000 with an interest rate of 5% and pays a 2/1 buydown fee of 1 point ($2,000). This situation means that the borrower's interest rate will be reduced to 4% for the first two years of their loan.

After those two years, the interest rate will increase to 5% for the remaining 28 years of the loan. This mortgage is a great way for borrowers looking to save money in the short term and still benefit from lower interest rates over time.

Another example of a 2/1 buydown would be if you had an existing mortgage and wanted to reduce your interest rate with a refinance. You could pay the 2/1 buydown fee to lower your interest rate and get some savings in the short term while still benefiting from lower rates over time.

How Much Does a 2/1 Buydown Cost

The cost of a 2/1 buydown can vary depending on the loan size, but it typically is around 1% of the total loan amount. If you have a $200,000 loan, your total cost for the 2/1 buydown is $2,000. It's important to note that this cost is in addition to any other closing costs associated with the loan. It depends on many factors, such as the lender, loan size, and credit score.

Advantages of a Buydown

Lower Interest Rate

The most attractive benefit of a 2-1 buydown is the ability to temporarily reduce your interest rate. This interest rate could mean significantly lower monthly payments than you'd otherwise be able to afford. Reducing your interest rate may also enable you to repay your loan faster, thus saving money on future interest payments.

Flexible Payment Options

Another great advantage of a buydown mortgage is that it allows for more flexible payment options. You can make a cash down payment at closing or use existing home equity (if applicable). This flexibility provides additional flexibility and could help you secure a better interest rate.

Ease into homeownership

For first-time homebuyers, a 2-1 buydown can be an excellent way to ease into homeownership. This type of financing allows borrowers to reduce their initial payments and avoid getting overwhelmed by high mortgage payments immediately. It also gives you more time to save up for the future down payment on your home or other expenses associated with owning a house.

Saving money

In addition to the short-term benefits of a 2-1 buydown, this financing could save you money in the long run. A lower interest rate could mean less money spent on interest in the future, which can add up over time. Furthermore, if you use existing home equity as a down payment, you could avoid paying Private Mortgage Insurance (PMI), which can be expensive.

Larger mortgage

Finally, a 2-1 buydown could help you secure a larger mortgage than you could afford. This benefit could enable you to purchase a larger home or acquire additional amenities without breaking your budget.

Disadvantages of a Buydown

Higher upfront costs

One of the main disadvantages of a buydown is that they require more upfront costs than traditional mortgages. Depending on the size and terms of your loan, this can mean paying thousands of dollars upfront to reduce your interest rate.

Problems with escrow

Another issue with buydowns is their effect on escrow accounts - or payments lenders make towards taxes and insurance on behalf of borrowers. Due to the initial lower payment structure, lenders may need more funds in an escrow account to cover these charges. This problem could lead to increased payments if additional money isn't added periodically into an escrow account.

Increased payments

Finally, it's important to remember that although these loans may offer a lower rate initially, borrowers will be responsible for the full mortgage payments after the buydown period ends. Therefore, this could be an issue if your financial situation changes and you can no longer pay the higher payment amounts at the end of your loan term.

When to Use a 2/1 Buydown

This strategy can be particularly beneficial for borrowers who may not qualify for the lowest interest rates but want to benefit from lower payments in the short term. If you plan on moving within two years or need additional financial flexibility after closing, this type of mortgage might be worth considering.

FAQs

Is a 2-1 buydown mortgage a good idea?

A 2-1 buydown mortgage can be a great option for borrowers looking to reduce their interest rate in the short term. However, it is important to note that you must make cash contributions or use home equity to securely finance this type of loan, so it should not be taken lightly!

Who pays for a 2-1 buydown mortgage?

The borrower pays a 2-1 buydown mortgage through cash contributions or home equity.

How much does a 2-1 buydown typically cost?

The cost of a 2-1 buydown mortgage will depend on the amount needed to lower the interest rate, the lender's fees, and other factors. Generally speaking, the cost can range anywhere from a few hundred dollars to several thousand. It is important to speak with your lender to determine the exact cost of your 2-1 buydown mortgage.

Conclusion

A 2/1 buydown is a great tool to have in your homebuying toolbox. You can use it to reduce your initial mortgage payments or strategically invest cash for lower payments. It can be useful when you don't qualify for lower rates and when additional funds are available for upfront costs. Be sure to plan since a buydown has potential drawbacks, such as having less equity up-front and being required to pay a buydown fee. To determine if this option is right for you, review the pros and cons of taking on an adjustable-rate 2/1 buydown, how it works, and how much it could cost you financially.