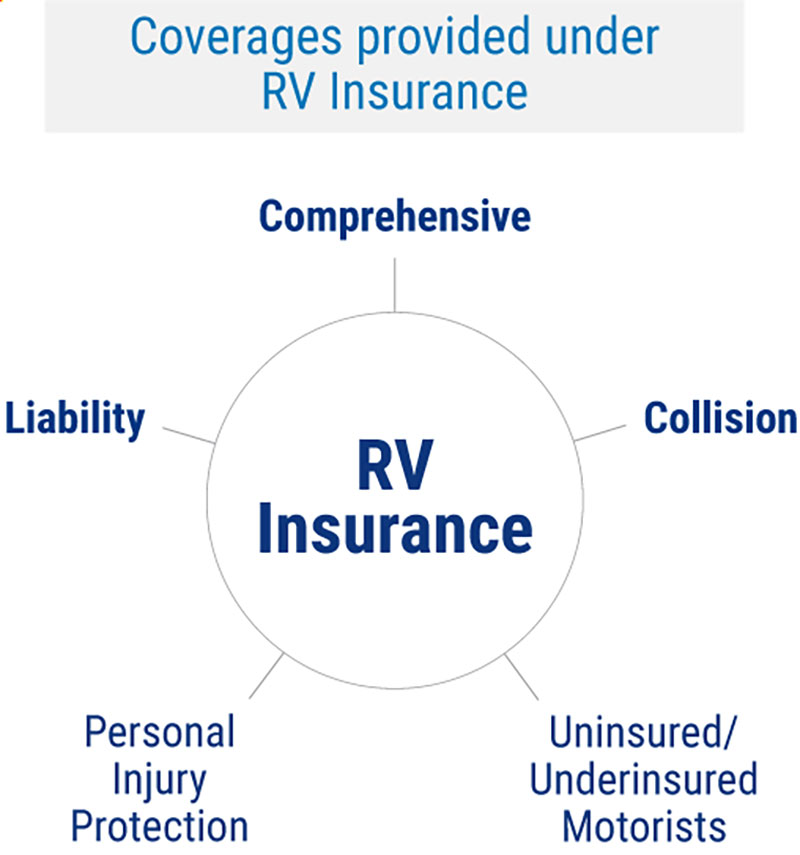

Are you considering an RV but need to know what insurance coverage requires? Having the peace of mind that comes with knowing your vehicle is adequately protected should be one of your top priorities. RV Insurance protects Recreational Vehicle owners against specific risks and can cover anything from bodily injury to damage from road conditions.

In this post, we will look at the different types of coverage available through RV Insurance policies and discuss why having them in place can provide reassurance as you travel the highways and byways.

Basic RV Insurance Coverage

Bodily injury liability

Bodily injury liability coverage is a must-have when it comes to RV insurance. It covers medical and other costs for any person injured in an accident caused by the RV owner. This type of coverage also can help cover legal expenses if a lawsuit is brought against the driver or owner for damages resulting from the accident.

It's important to note that bodily injury liability does not protect you financially but pays for any damages done to another person due to your negligence while driving your RV.

Uninsured motorist

Uninsured motorist coverage is an additional form of insurance that protects you and your RV if you are involved in an accident with a driver who does not have insurance.

This policy will help cover any medical expenses incurred by yourself or your passengers and repair costs to your RV. It can also provide peace of mind knowing you're financially protected even if the other driver doesn't have insurance. Uninsured motorist coverage is especially important if you frequently travel to states where it may be harder to find affordable auto insurance.

This type of coverage gives you added protection and ensures you'll return to the road quickly after an unexpected incident.

Property damage liability

Property damage liability coverage is a type of insurance that can protect RV owners in the event their vehicle causes damage to another person's property. This coverage includes any buildings, fences, other vehicles, and more.

Property damage liability does not protect you financially but will help with repairs or replacement costs if your RV damages someone else's property. This type of coverage is important because, as an RV owner, you are responsible for any damages caused by your vehicle.

Property damage liability helps you avoid financial hardship if the worst-case scenario happens, and you are liable for significant damage caused by your RV. This type of coverage provides peace of mind when on the road.

Underinsured motorists

Underinsured motorist coverage is another type of insurance that can protect you in an accident with a driver who does not have enough insurance to cover your costs. This policy helps pay for medical expenses, repair costs, or other damages caused by someone else's inadequate insurance limits.

Having underinsured motorist coverage ensures you are protected even if the other driver doesn't carry enough auto insurance to fully cover your financial losses or damage to your RV. It also provides reassurance that an extra layer of protection is in place should something unexpected occur while on the road.

Collision

Collision coverage is an important type of RV insurance that can help protect you and your vehicle from damage caused by a collision. This policy can provide financial assistance to repair or replace your RV if it's damaged in an accident with another motorist or object.

It also helps cover the costs of any medical expenses incurred by anyone involved in the accident, regardless of who was at fault. Collision coverage gives peace of mind that if something does happen, you won't have to pay for any repairs out-of-pocket.

This coverage also ensures you'll return to the road quickly and safely after an unexpected incident.

Medical payments

Medical payments coverage is a form of RV insurance that helps pay for medical bills resulting from a collision, regardless of who is at fault. This type of policy protects if you or any passengers in your RV are injured in an accident and need to seek medical treatment.

It covers the costs of hospital stays, doctor visits, physical therapy, X-rays, and other related expenses.

Medical payments insurance can also help cover lost wages due to an injury caused by an accident involving your RV. This type of coverage gives you peace of mind knowing that your financial burden will be borne if something unexpected occurs while on the road.

Comprehensive

Comprehensive coverage is a type of RV insurance that can provide financial protection for your vehicle if an incident does not involve another vehicle. This coverage includes vandalism, theft, fire, floods, and hail damage.

Having comprehensive coverage helps ensure you won't have to pay for any repairs or replacement costs out-of-pocket if your RV is damaged due to unforeseen circumstances. It also gives peace of mind knowing that even if something unexpected occurs while traveling, your vehicle is protected against financial loss.

Optional RV insurance coverage

Roadside assistance

Roadside assistance is an optional coverage often included in RV insurance policies. It can be invaluable for unexpected breakdowns and other emergencies, especially when you're far from home. Roadside assistance typically covers towing costs, fuel or other fluids delivery, and minor repairs. It ensures that if you run into car trouble on the road, help is just a phone call away.

Safety glass replacement

Safety glass replacement is important to consider in your RV insurance policy. It covers replacing any safety glass damaged in an accident or other calamity. Safety glass is specially designed to reduce the risk of injury from shattered pieces, and this coverage ensures you don't have to pay out-of-pocket for such a costly repair should something happen.

Towing &'' labor

Towing &'' labor coverage is also an important part of any RV insurance policy. It covers the cost of towing your vehicle in case of a breakdown or accident and labor costs for minor repairs such as changing a tire.

This type of coverage provides peace of mind that you won't be left stranded should something go wrong while on the road. With this coverage in place, you can rest assured that help is just around the corner!

Replacement cost and scheduled personal effects

Replacement cost coverage is an important part of RV Insurance and covers the costs associated with replacing your Recreational Vehicle if damaged. Additionally, Scheduled Personal Effects coverage protects any personal items inside your RV that may be lost or stolen while on the road.

This coverage helps ensure that should something happen to your belongings, they can be replaced without bearing the full financial burden yourself.

Vacation liability

Vacation liability coverage is a crucial part of RV Insurance. It helps protect you from third-party claims related to bodily injury or property damage while using your RV as a temporary residence. This coverage can provide financial protection in case of an accident, ensuring you won't be left with large bills to pay.

FAQs

Does RV insurance cover the damage?

Yes, RV insurance typically covers physical damage and liability from road conditions.

Does RV insurance cover items inside?

Yes, most RV insurance policies cover personal belongings inside the vehicle and some necessary supplies (such as towing) you might need while traveling.

Do I need an RV-specific policy?

Yes, most standard policies do not cover Recreational Vehicles, and it is important to

purchase a specialized policy to ensure full protection for your vehicle and passengers.

Conclusion

Researching and understanding what RV insurance covers is imperative to ensure you are adequately protected while on the road. Basic coverage includes collision, comprehensive, liability, and uninsured motorist protection. Comprehensive coverage can provide additional protection for your motor home should it be damaged by theft or vandalism. Optional coverage like roadside assistance, replacement costs on personal belongings, and vacation liability can all provide additional peace of mind should any incidents arise while traveling.